Wählen Sie Ihre Sprache

Prof. Dr. Jürgen Moormann

Professor für Bank- und Prozessmanagement (Emeritus)

Zur Person

Berufsausbildung bei der Commerzbank AG in Kiel (1977-1979). Studium der Betriebswirtschaftslehre an den Universitäten Kiel und Zürich (1980-1985). Von 1986 bis 1989 wissenschaftlicher Mitarbeiter am Lehrstuhl für Finanzwirtschaft der Christian-Albrechts-Universität in Kiel. Promotion. Anschließend fünf Jahre Tätigkeit in der Unternehmensberatung. Lehraufträge u.a. an der EBS Universität für Wirtschaft und Recht, Oestrich-Winkel, und der Universität Liechtenstein, Vaduz.

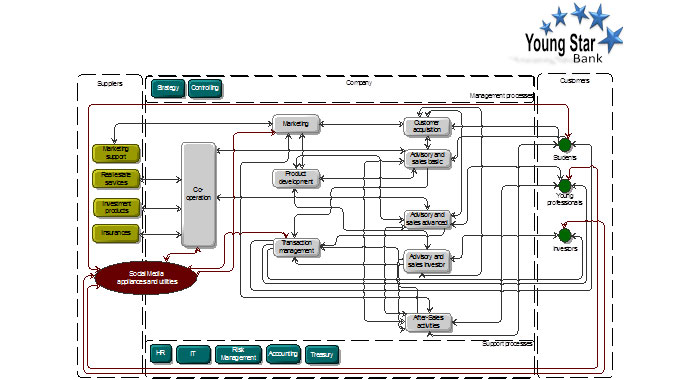

Seit 1995 Professor für Bank- und Prozessmanagement an der Frankfurt School of Finance & Management. Schwerpunkte in Lehre und Forschung sind Strategieentwicklung, Business Engineering und Prozessmanagement in Banken.Von 2005 bis 2022 Leiter des ProcessLab - eines auf das Prozessmanagement in der Finanzbranche ausgerichteten Forschungscenters der Frankfurt School. Von 2014 bis 2018 Inhaber der Concardis-Stiftungsprofessur für Bank- und Prozessmanagement. Gastprofessor an der University of Colorado at Colorado Springs, der University of New South Wales, der Queensland University of Technology und der University of Hong Kong, China.

Positionen in Beiräten, Jurys etc.

Vorsitzender des Aufsichtsrates der Karis AG, Darmstadt

Mitglied des wissenschaftlichen Beirats des International Bankers Forum e.V., Frankfurt a.M.

Vertrauensdozent der Friedrich-Naumann-Stiftung, Berlin

Associate Editor der Fachzeitschrift "Knowledge Management & E-Learning: An International Journal"

Mitglied im Programmkomitee der „Global Business Conference” (Croatia)

Mitgliedschaften in akademischen Organisationen

Association for Information Systems (AIS)

BPM Association

Gesellschaft für Informatik e.V., Bonn

Verband der Hochschullehrer für Betriebswirtschaft e.V., Köln

Kurse

| Titel | Studiengang | Semester |

| Prozessmanagement | BA | Sommer |

| Strategy and Organization | Bachelor | Sommer |

| Business Engineering | Bachelor | Winter |

Themen für Masterarbeiten

Prof. Dr. Jürgen Moormann

Suggestions for Master Theses 2025:

-

Human-centric Business Process Design

Burnout and other work-related mental health risks are increasing rapidly. Therefore, the way work is organized needs to be reviewed and revised. This approach focuses on business processes. How can processes be designed taking into account individual attitudes, strengths, weaknesses, emotions, etc.? Both conceptual work and case studies are possible. Starting point is the book “Process Management and Burnout Prevention” (Bogodistov/Moormann).

Business processes, burnout, psychology, responsible BPM

-

The Future of Process Management

The history and core components of current business process management (BPM) are well known. What are the next steps? Taking into account the increasing awareness of the environment, employees, customers, etc., the approach of responsible BPM is on the rise. The thesis is intended to discuss topics of responsibility along various stages in the BPM lifecycle – including responsible analysis, design, and performance, which concern both the computational and business side of BPM.

Responsible BPM Forum, process management, human resources, artificial intelligence

-

Business Model Development based on Patterns

How to develop business models? One promising approach is the use of business model patterns. According to Ngal/Bozen (2018), more than 90% of new business models are based on familiar concepts or established business models. How can this approach be used to develop and adapt business models in the financial services sector? As a starting point, I provide you with a conference paper on this topic.

An application to banking (and thus a banking background) is desirable.Business model, business model patterns, financial services industry

- Distributed Ledger Technology and its Integration into the IoT

The Internet of Things (IoT) is becoming an important area of technological advancement. An interesting research question is how Distributed Ledger Technology (DLT) consensus protocols can support the utilization of IoT. Some initial research has already been conducted. In this thesis, it planned to revise or extend an existing framework by means of interviews with experts in the field of blockchain and IoT.

Distributed Ledger Technology, IoT, consensus protocols

-

Measuring CO2 Emissions in Financial Services

As we know, consumption generates a large amount of CO2. The same is true for the usage of financial services, e.g. if we conduct payments (cash, cards etc.). How can the CO2 emissions of card-based payment transactions be measured? Is there a paradox in the payment industry (CO2 savings by reducing cash, but otherwise generating CO2?)?

Payments, business model, sustainability

-

Usage of AI for Reused Products

The reuse of products is playing an increasingly important role in a world that is striving for greater sustainability. How can artificial intelligence be used in this endeavor? Another field of analysis could be the use of AI for perishable products such as tomatoes. Methodology: Literature, field study, interviews, conceptual work. For bankers: What might financial considerations look like in this context?

Sustainability, reuse, artificial intelligence

Themen für Bachelorarbeiten

Prof. Dr. Jürgen Moormann

Vorschläge für Bachelor-Thesen 2025

(englisch oder deutsch)

- Open Finance – status quo, future steps and implications

Following the Digital Finance Strategy (EU commission), GDPR, PSD 2 (with PSD 3 soon coming), the next step will be FIDA (Framework for Financial Data Access). What are technical and strategic prerequisites to allow Open Finance (here: Open Banking)? What is the status quo? What are next steps? And even more important: What does this mean for banks?

Banking background is necessary.

Open finance, business model, processes, APIs, banks

- Digital Euro – why merchants would want to accept CBDC?

It can be assumed that the digital euro will arrive in the foreseeable future. However, without the acceptance of merchants, its distribution will be a challenge. For which use cases is the digital euro necessary? Are there alternatives? What could be the advantages/disadvantages from the retailers' point of view? Is it necessary to differentiate between different groups of merchants?

Digital Euro, merchants, retailers

- Everybody gets older: Inclusion of seniors in banking services

Inclusion is a big topic in many industries. The focus of this thesis should be seniors in acquiring and using banking (insurance) services. Thus, what are the criteria for seniors’ inclusion? Are there standards/rules available? The student is asked to do a (customer-centric) process analysis. Case studies, interviews, comparisons to other industries might be suitable methodological approaches to cope with this topic. In addition, Design Thinking might be helpful.

Banking background is needed.

silver agers, seniors, banking, inclusion, customer processes

- DLT in the face of the Internet of Things

The student is expected to analyze potential and existing applications of distributed ledger technologies (including blockchain and DAG, directed acyclic graph) with respect to the Internet of Things. In this thesis, it planned to revise or extend an existing framework by means of interviews with experts in the field of blockchain and IoT.

DLT, blockchain, consensus protocols, DAG, IoT

- Klimaneutralität in Geschäftsprozessen

Beispielsweise will die Otto Group bis 2030 in ihren Geschäftsprozessen klimaneutral sein, d.h. den Anteil nachhaltiger Produkte erhöhen. Alle Versandverpackungen sollen recyclelt, biologisch abbaubar oder mehrwegfähig sein. Die Partner auf dem Otto-Marktplatz sollen verpflichtet werden, Kennzahlen zu CO2-Emsionnen offenzulegen. Was bedeutet dieser Ansatz für Banken und andere Finanzdienstleister?

Banking-Hintergrund ist wünschenswert.

Nachhaltigkeit, Geschäftsprozesse, Banken

- Measuring CO2 Emissions in Financial Services

As we know, consumption generates a large amount of CO2. The same is true for the usage of financial services, e.g. if we conduct payments (cash, cards etc.). How can the CO2 emissions of card-based payment transactions be measured? Is there a paradox in the payment industry (CO2 savings by reducing cash, but otherwise generating CO2?)?

Payments, business model, sustainability

Ausland

University of Hong Kong (HKU), China

Okt./Nov. 2009, Okt. 2011, Nov. 2013, Okt. 2014, Nov 2023

mehrwöchige Forschungsaufenthalte an der University of Hong Kong (HKU), China; Bereich: Faculty of Education, Division of Information & Technology Studies

Einladung: Prof. Maggie Minhong Wang

– Vorträge in der Faculty of Education, 2009, Hongkong

– DAAD/PPP-Projekt 2013 und 2014

Queensland University of Technology (QUT), Brisbane, Australien

Nov./Dez. 2009, Aug./Sept. 2007, Juli/Aug. 2012, Nov./Dez. 2014, Nov./Dez. 2019

mehrwöchige Forschungsaufenthalte an der Queensland University of Technology (QUT), Brisbane, Australien; Bereich: Science and Engineering Faculty, School of Information Systems und School of Management

Einladung: Prof. Dr. Michael Rosemann

- Vortrag auf der Australasian Conference on Information Systems 2019, Perth

- Vortrag auf der Australasian Conference on Information Systems 2014, Auckland, NZ

- DAAD/ATN-Projekt 2012 und 2013

- Vorträge auf der Australasian Conference on Information Systems 2009, Melbourne

- Vortrag auf der Australasian Finance and Banking Conference 2009, Sydney

- Vortrag auf der International Conference on Business Process Management 2007, Brisbane

University of New South Wales (UNSW), Sydney, Australien

Okt.-Dez. 2004

3-monatiger Forschungsaufenthalt an der University of New South Wales (UNSW), Sydney, Australien

Bereich: Australian School of Business, Banking and Finance

Einladung: Prof. Terry S. Walter

- Teilnahme an der Australasian Finance and Banking Conference 2004, Sydney (Session Chair)

University of Colorado at Colorado Springs (UCCS), USA

WS 1999/2000

6-monatiger Lehr- und Forschungsaufenthalt an der University of Colorado at Colorado Springs (UCCS), USA

Bereich: College of Business and Administration, Department of Accounting/Finance/Information Systems

Einladung: Prof. Tom Zwirlein

Unterricht des Kurses „Finance 305“ (3. Jahr Bachelor of Science)